17 May 2022Events, Roundtables

POPULAR CONTENT

17 May 2022Events, Roundtables

07 March 2023Climate Change, Publications, TCFD

28 November 2022Publications, SDGs and Impact

Despite one of the most challenging years in living memory for businesses around the globe, including financial institutions, UNEP FI and our members continued to work together throughout 2020 towards crafting a more sustainable financial system.

COP26 Champions welcome study as enabling rapid net-zero transition Geneva, 10 December 2020 – Based on the 2019 One Earth…

Today, UNEP FI published a summary of the first reporting from the 38 banks who are signatories to the Collective Commitment to Climate Action (CCCA), the most ambitious global banking sector initiative supporting the transition to a net zero economy by 2050.

200 banks across 58 countries and 6 continents have now signed UNEP FI’s Principles for Responsible Banking, thereby committing to align their strategy and practice with the goals of the Paris Agreement on Climate Change and the Sustainable Development Goals.

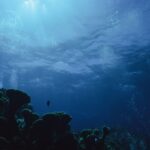

Oceans cover 71% of the world's surface, giving Earth the befitting title of the ‘Blue Planet’. The ocean is a planetary superpower that sustains the lives of billions of people and countless marine wildlife. For instance, approximately 3 billion individuals globally are dependent on protein from the ocean for food security. This pivotal role in the global economy establishes the ocean as a vitally important asset to underwriting, lending and investment activities, in businesses which either depend on or impact the ocean and its services.

For financial institutions in Mongolia: we are holding a webinar that will introduce the Principles for Responsible Banking and forward-looking climate assessment in line with the recommendations for the Task Force on Climate-related Financial Disclosures. With English-Mongolian translation.

The Norwegian financial group said it had signed the United Nations-backed Sustainable Blue Economy Finance Principles, a guiding framework launched in 2018 for financing a sustainable ocean economy. Storebrand – one of Norway’s main occupational and personal pension providers – said the framework aimed to accelerate the transition towards sustainable use of the ocean and its resources by developing practical actions for insurers, lenders and investors to undertake.

The United Nations-convened Net-Zero Asset Owner Alliance has added three new members with combined assets under management (AUM) of $200…

Financial institutions in Colombia, Peru and South Africa are beginning to tackle nature-related risks, exemplifying a trend across emerging markets…

American Hellenic Hull Insurance Company announced today that it has signed the Sustainable Blue Economy Finance Principles joining a growing…