17 May 2022Events, Roundtables

POPULAR CONTENT

17 May 2022Events, Roundtables

07 March 2023Climate Change, Publications, TCFD

28 November 2022Publications, SDGs and Impact

Members of the 30-strong UN-convened Net-Zero Asset Owner Alliance have published their position on thermal coal, calling for the cancellation…

The Dutch Central Bank and financial supervisor, De Nederlandsche Bank (DNB), is the first central bank to highlight biodiversity as…

UNEP FI has released a detailed user Guide for the Portfolio Impact Analysis Tool for Banks, as well as the first updates to its in-built country needs assessment framework, one of several unique in-built resources of the Tools.

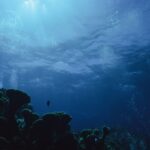

We cannot have a healthy planet without a healthy ocean, and in any global discussion on biodiversity the ocean must…

The blue economy is an attractive opportunity for banks and insurance companies, yet some players are rushing to invest without first adopting sustainability principles that can avoid repeating the wrongs of the past, says world-renowned ecologist Enric Sala.

Principles for Responsible Banking is first finance sector initiative to put into practice signatories’ commitments to robust accountability and broad…

UNEP FI kicked off Day 2 of its Global Roundtable with another day full of high-level keynotes, plenaries, regional focused…

Eric Usher of the UN Environment Programme Finance Initiative and Corli Pretorius of the UN Environment Programme World Conservation Monitoring Centre say banks should urgently set targets for financing the protection of nature in the critical next decade in the same way that many have set climate targets

Thirty of the world’s largest asset owners, with portfolios worth a combined $5tn (£3.8tn), have committed to cutting the carbon emissions linked to companies they invest in by up to 29% within the next four years. Members of the UN-backed Net-Zero Asset Owner Alliance – which includes Aviva, the Church of England and the $400bn US fund CalPERS – will each set decarbonisation targets for 2025 as part of wider efforts to align their portfolios with the Paris climate goals and achieve net-zero emissions by 2050.

Former Bank of England governor Mark Carney has said banks should link executive pay to climate risk management, as part of efforts to align the finance industry with Paris climate goals. Speaking at the UN Environment Programme Finance Initiative roundtable on Tuesday, the former central bank boss said lenders should – at the very least – be transparent over whether or not pay is being tied to climate targets.